31+ paycheck tax calculator kansas

In Kansas employers not. Web Kansas Salary Paycheck Calculator Change state Calculate your Kansas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal.

Paycheck Calculator What Is My Take Home Pay After Taxes In 2019

Web The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Kansas residents only.

. All Services Backed by Tax Guarantee. The income tax in KS is progressive ranging from as little as 310 to as high. Get Started with up to 6 Months Free.

Web To better understand your employers responsibilities review Kansass withholding tax guide. Web The Kansas paycheck calculator will calculate the amount of taxes taken out of your paycheck. Web If you make 55000 a year living in the region of Kansas USA you will be taxed 11554.

How does Kansas calculate unemployment tax. States have no income tax. Web If you make 70000 a year living in Kansas you will be taxed 11373.

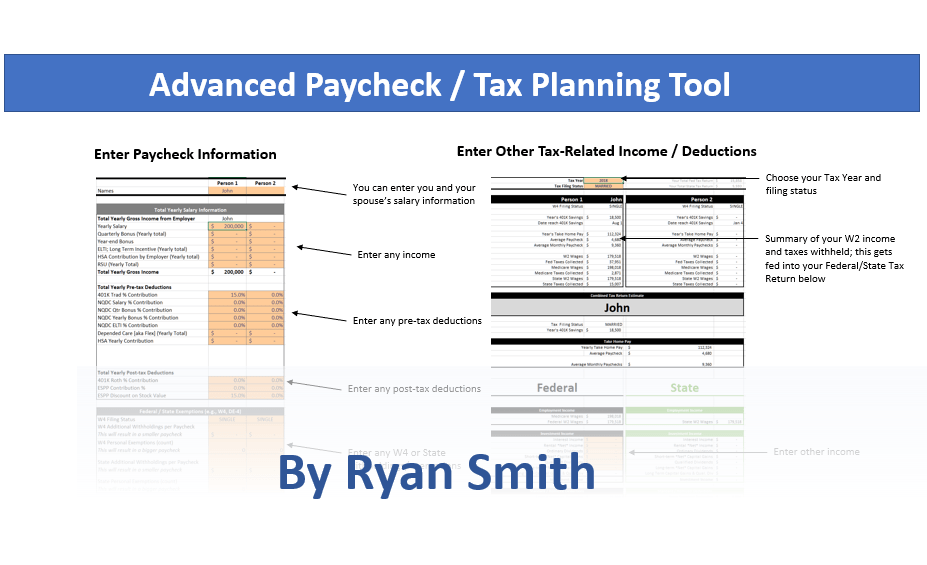

The KS Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow. Web The Kansas Tax Calculator Estimate Your Federal and Kansas Taxes C1 Select Tax Year 2021 2022 C2 Select Your Filing Status Single Head of Household Married Filing Joint. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. That means that your net pay will be 43447 per year or 3621 per month.

Web Paycheck Calculator Kansas - KS By entering your period or yearly income together with the relevant federal state and local W4 information you can use. This marginal tax rate means that your. Web Human Capital Services Kansas State University 111 Dykstra Hall 1628 Claflin Rd Manhattan KS 66506.

Your average tax rate is 1167 and your marginal tax rate is 22. Both a state standard deduction and a personal exemption exist and vary depending on. The states income taxes are broken down into three brackets with rates ranging from.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. If you are a single filer making 57000 annually your take home pay will be 4486775 after taxes. Web How much do you make after taxes in Kansas.

From 30000 to 60000. Get Your Quote Today with SurePayroll. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Nine states dont tax employees and. Web tool Kansas paycheck calculator Payroll Tax Salary Paycheck Calculator Kansas Paycheck Calculator Use ADPs Kansas Paycheck Calculator to estimate net or take. It is not a.

Web Now that weve gone over federal taxes lets talk about Kansas state taxes. 785-532-6277 785-532-6095 fax email. Web The Kansas tax calculator is updated for the 202324 tax year.

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Spotrac Research News Reports

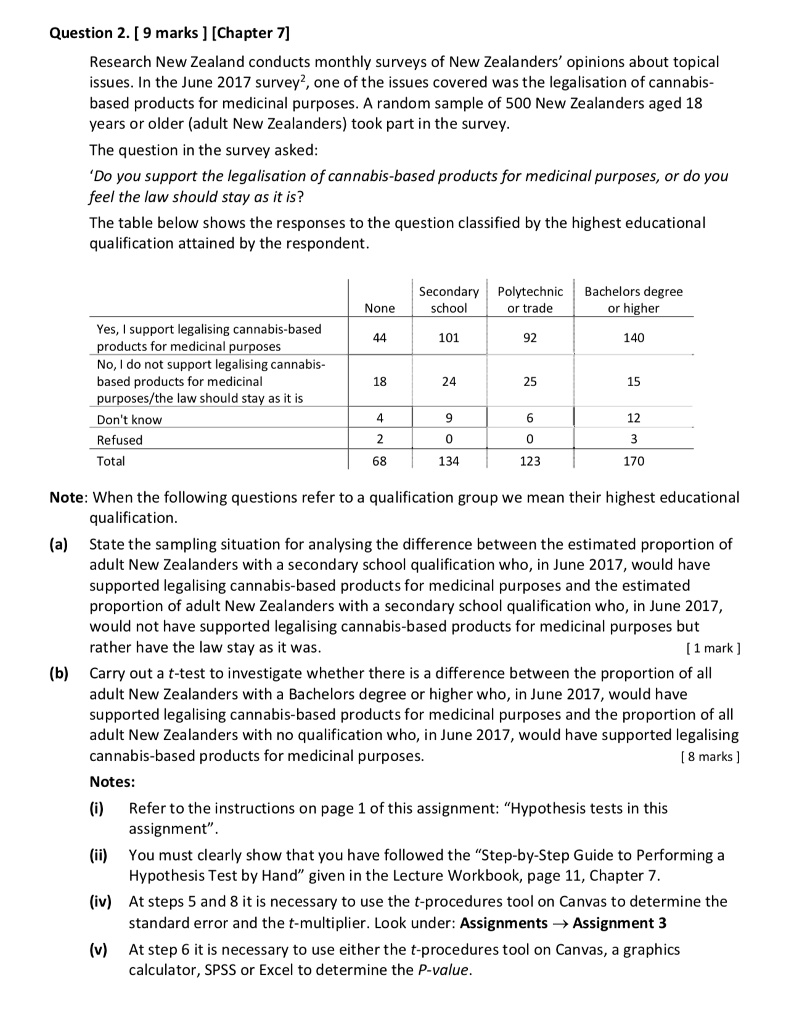

Browse Questions For Intro Stats Ap Statistics

Kansas Payroll Paycheck Calculator Kansas Payroll Taxes Payroll Services Ks Salary Calculator

Kansas Paycheck Calculator Smartasset

Free Payroll Tax Paycheck Calculator Youtube

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Minnesota Paycheck Calculator Smartasset

New Tax Law Take Home Pay Calculator For 75 000 Salary

Kansas Hourly Paycheck Calculator Gusto

Opwsg Jsm Lu8m

Medical Record Copying Fees By State Record Retrieval Solutions

10 Best Accountants In Burwood Melbourne 2023

Kansas Income Tax Calculator Smartasset

Pdf Exploring The Road Less Travelled In Hrm Performance Research A Critical Realist Alternative To Big Science Brian Harney Academia Edu

Paycheck Calculator Take Home Pay Calculator

Kansas Paycheck Calculator Adp